spread forex meaning

What is a Spread in Forex Trading. It represents the difference between the selling and buying prices of particular currencies.

What Does A Forex Spread Tell Traders

There are other ways how broker can make money like fixed fees taking other side of the trade but spread is one of usual ways of their income.

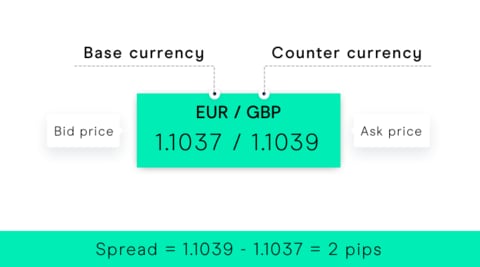

. Spreads Forex definition is very simple although it might sound a little confusing. The spread is a difference between the bid and ask price for any tradable instrument. Once again set in pips for convenient calculation.

Spread is in simple terms a sort of commission that brokers and specialists are able to collect on every forex trade. One of them is Bid price and the other is Ask price. Understanding Spread In Forex What Is It.

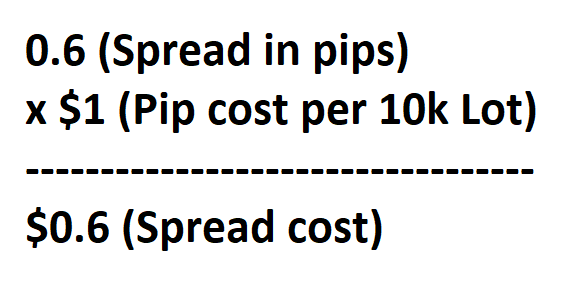

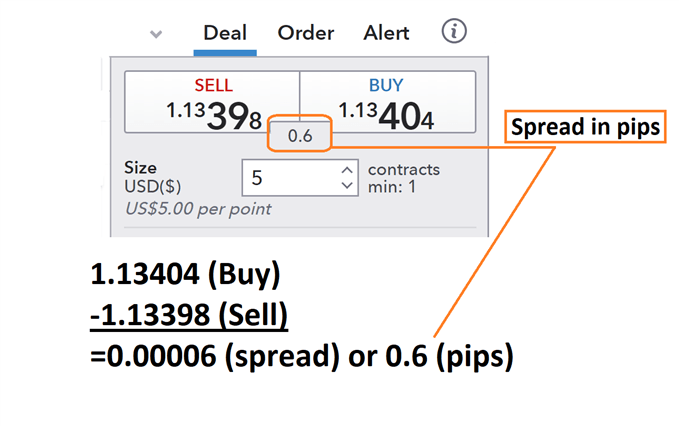

The forex spread is the difference between the exchange rate that a forex broker sells a currency and the rate at which the broker buys the currency. This is the simplest way to understand what a spread is. For beginner traders it is important to understand how forex spreads work how to calculate them and why they exist at all.

Spread is the difference between. We have two prices in a currency pair. It depends on the trading strategy used.

Spread is one of the key terms in the Forex market. It basically is a difference between the bid price and the ask price of the currency pair. Heres what is spread in Forex trading.

The definition of the concept is quite simple. This means you need the market to rise by one point the size of the spread just to break even on your trade. Spread is one of the most commonly used terms in the world of Forex Trading.

The trading price for any currency pair is expressed by. Spread is the difference between the selling and buying prices of an asset. Floating spread on Forex and CFD markets is a constantly changing value between Ask and Bid prices.

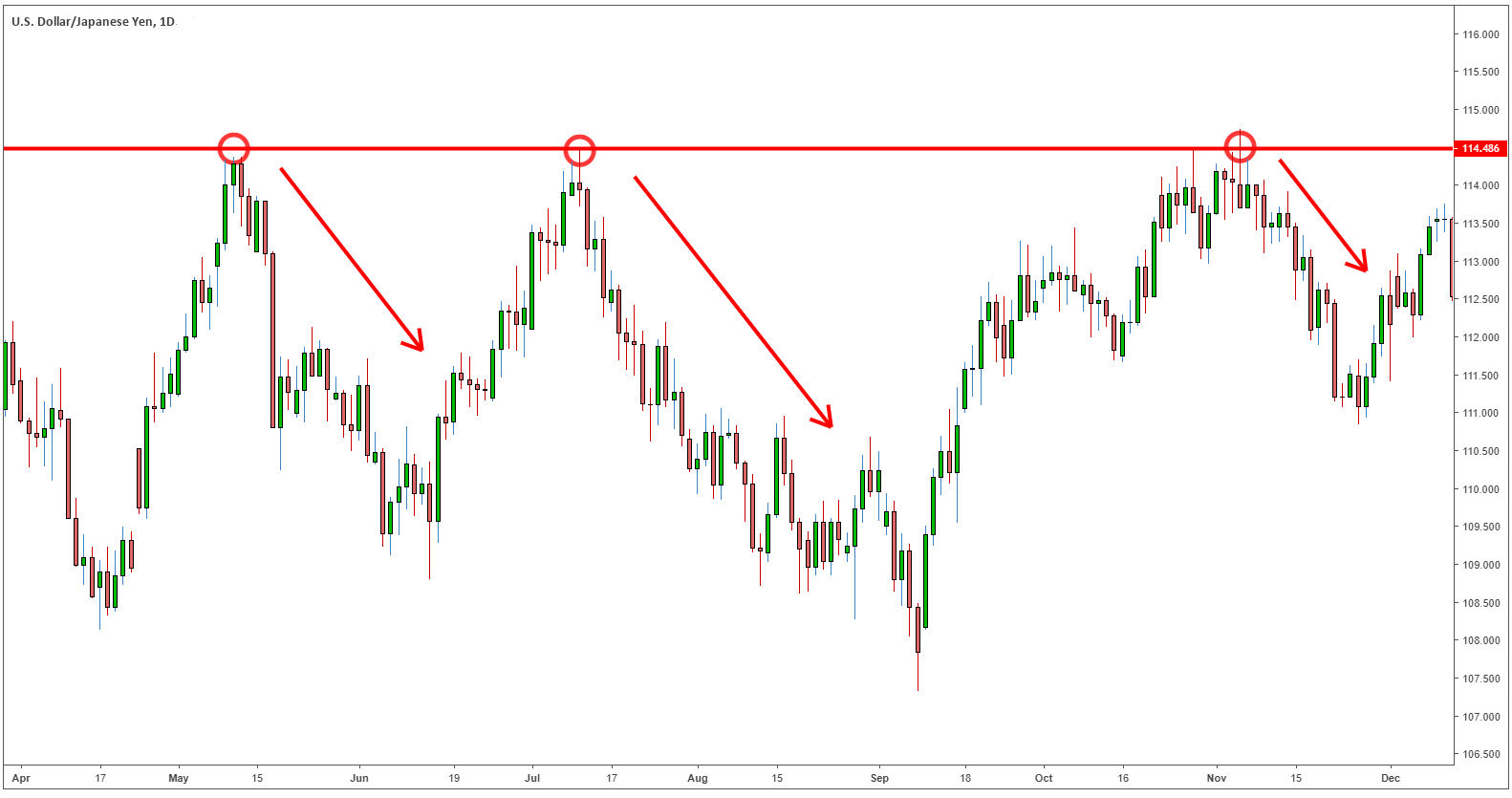

The forex spread is one of the ways brokers make money from a forex position. In the foreign exchange Forex market a spread is the gap between the bid and ask prices of a currency pair Currency Pair A currency pair is a combination of two different national currencies valued against one another. Every market has a spread and so does forex.

The bid is the price at which you buy a currency pair and the ask is the price at which you sell. A spread determines the future costs a trader will have to face which makes it a valuable term to learn. A forex spread is the difference between the bid sell price and the ask buy price of a currency pair and it is essentially how a broker makes money without charging a commission on a transaction.

To comprehend what a spread is imagine any trading operation such as buying clothes for resale. This is also many times referred to as bidask spread it can also be said that the spread very well represents the supply and demand for currencies. One of the key competitive assets of most brokers in the forex market is the spread size for currency pairs.

Spread Ask the price a buyer is willing to pay Bid the price at which a market maker is willing to buy. If the bid price overtakes the price at which you bought youre on the road to profit. EURUSD is priced at 11500 the broker will offer it for 11501 to buy or sell at 11499.

Usually the Forex spread is how the broker. Why Calculate the Cost of the Spread. The spread is the price differential between the bid and asks prices.

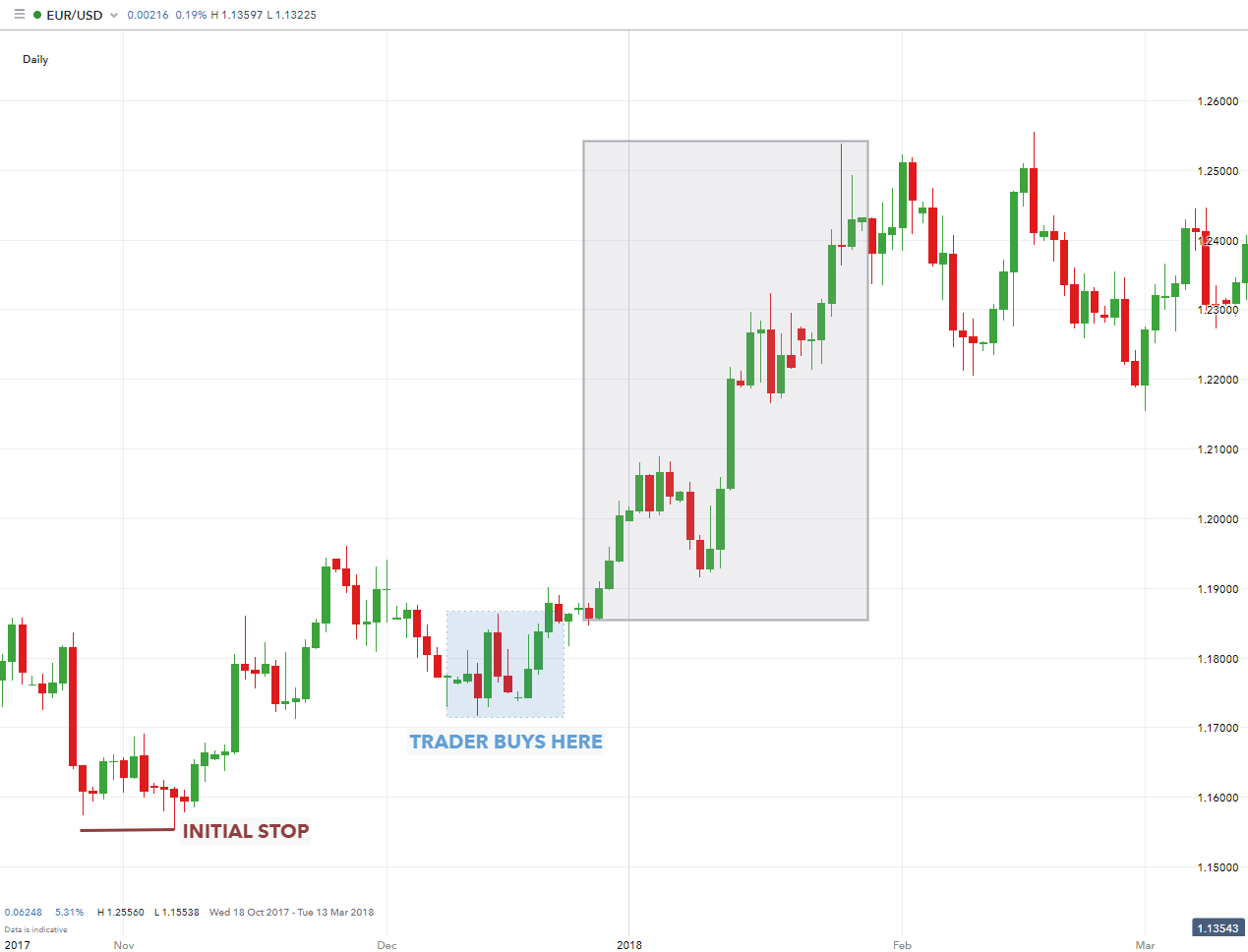

The smaller the timeframe and the larger the number of transactions the more cautious you should be when it comes to spreading. Thus along with the usual trading accounts with floating spread a number of companies offer clients so-called ECN accounts. Spread meaning in Forex is money money which broker will make from you when you open an order.

What is Forex spread - the meaning of the spread in trading. Ad Learn More With Our FX Trading Insights And Explore All Accessible Products To You. A spread is simply defined as the price difference between where a trader may buy or sell an underlying asset such as the currency pairs.

The first is the bid price which is the price that you can sell the base currency. This commission is passed on to you the trader where it translates into the difference between the bid sell price and the ask buy price of a given currency pair. Floating spread is a completely market phenomenon and most of all interbank relations are characterized by it.

When it comes to the spread meaning in Forex it deprives from subtracting the bid price from the ask price and it all occurs during trading so that you dont need to specifically pay anything. Spread is there because broker needs a way how to make money while providing you a service. Come And Connect With The Global FX Community And Other Financial Professionals.

Your Forex broker will give you two different prices for a currency pair. The spread is the costs you will have to face in each trading transaction. Spread in Forex PDF Explained.

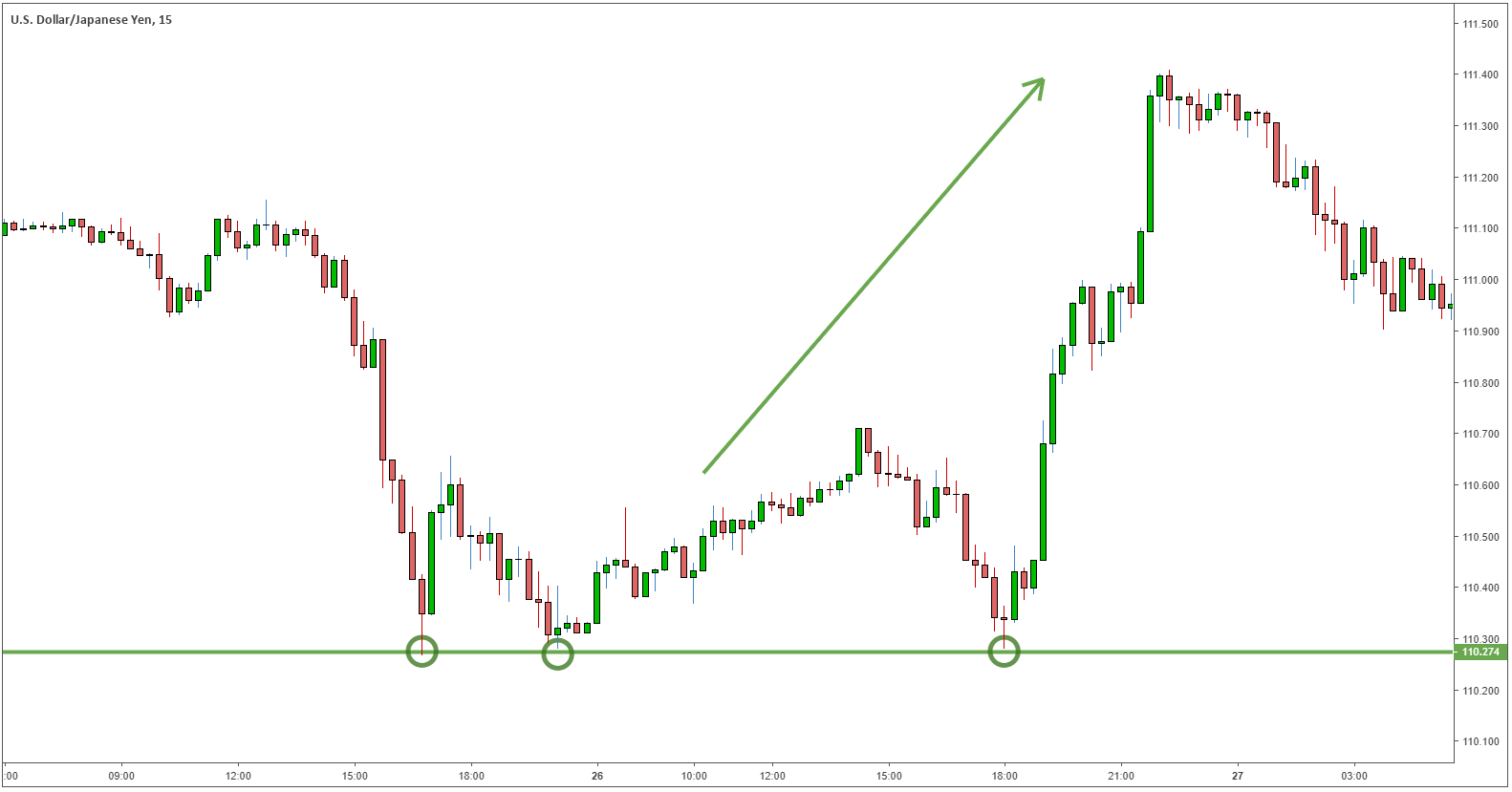

Traders that are familiar with the currency pairs involved spread- the Bid. Spread is crucial because it can help determine where to buy or sell a currency pair at a given time. Below we can see an example of the forex spread being.

A spread is also the easiest way for many brokers to get compensated for each transaction the customer makes through their trading platforms. Forex lot size meaning. Its one of the most popular commission charges used by brokers.

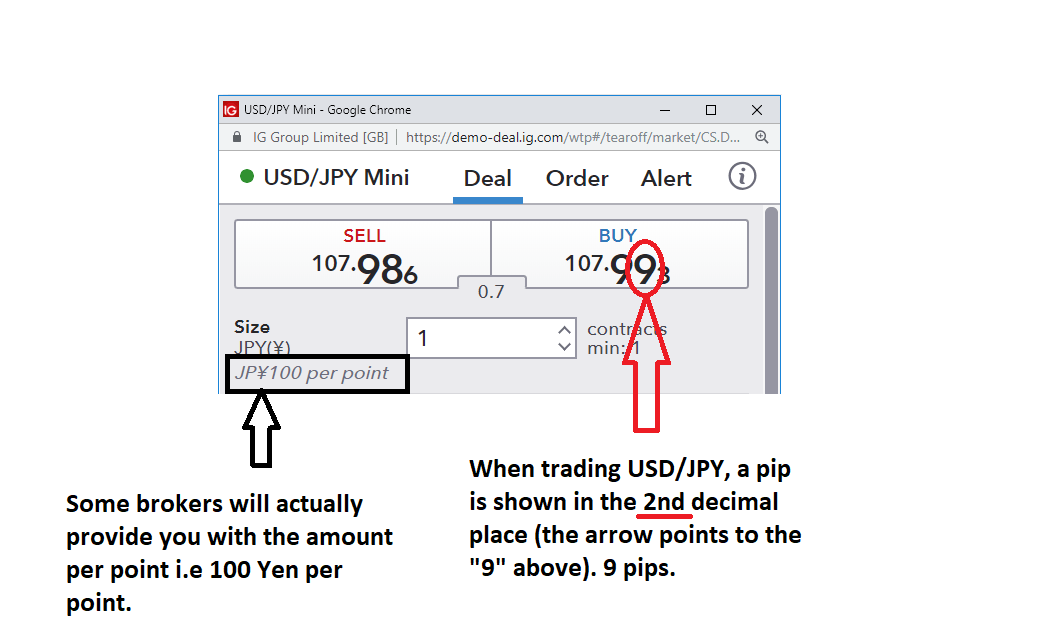

In this example the bid price rises from 12872 to 12875 three points so your gain is based on a two-point movement. Each trader has his degree of sensitivity to the cost of the spread. In Forex it is usually expressed in pips- meaning one pip equals 00001.

Forex spread meaning is quite simple. For example if the quote of the GBPUSD currency pair is bid 12920 and ask 12923 then Spread 12923-12920 0003 USD or 3 pips. You will notice that there is a slight difference between the two prices.

The second is the ask price which is the price that you can buy the base currency.

What Is Spot Fx How To Trade Spot Currencies Ig Uk

:max_bytes(150000):strip_icc()/dotdash_Final_The_Ins_and_Outs_of_Forex_Scalping_Dec_2020-01-81923a49069940e09317c2eb3bb8b3cc.jpg)

The Ins And Outs Of Forex Scalping

What Does A Forex Spread Tell Traders

Long Vs Short Positions In Forex Trading

What Is Spread In Forex Learn Forex Cmc Markets

What Is A Pip Using Pips In Forex Trading

Long Vs Short Positions In Forex Trading

Types Of Forex Orders Babypips Com

Spread Meaning Trading Examples Top 5 Types

What Does A Forex Spread Tell Traders

Using Stop Loss Orders In Forex Trading

Spread Meaning Trading Examples Top 5 Types

04 What Is Spread Fxtm Learn Forex In 60 Seconds Youtube

Spread Definition Forexpedia By Babypips Com

Understanding Forex Quotes Bid Ask Forex Com

/dotdash_Final_Standard_Lot_Apr_2020-01-133fbce6dddf4c5fbe6be4fb72e0c734.jpg)

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

/dotdash-INV-final-Bond-Spreads-A-Leading-Indicator-For-Forex-Apr-2021-01-5f06416c041d49c083116bd4d3d61cf2.jpg)